It covers all employees, students, trainees, pensioners and their respective families. It is likely you will be obliged to join the system when living in Germany, although there are some exceptions.

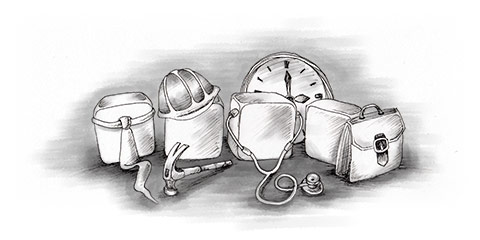

The term ‘social security’ covers five main categories - the ‘5 pillars’ of the social security system:

- Health insurance

- Long-term care insurance

- Pension insurance

- Unemployment insurance

- Work accident insurance

Work accident insurance is fully paid by employers. Contributions for the rest are equally shared between employer and employee. These are calculated as a percentage of your gross income, and in some cases capped to a certain income level. Total contributions are around 40 percent of gross salary, so you should expect to pay about 20% of your salary into the system. Contributions are deducted directly from your salary. If you are self-employed you pay the contributions yourself.

If you are a geringfügig Beschäftigter (restricted employee), i.e. you work less than 50 days or 2 months a year, or if you have a € 400-Job (income less than €400/month) you do not pay German social security or tax. However, you must still be registered for health insurance.

Students: All students are obliged to have health insurance, and you will be required to provide proof of this before you can register at a German university or college. Without this, you will not be able to study (see our section on health insurance for further information). Work accident insurance is paid by your university.

International social insurance: Within the EU there is an agreement which allows benefits to be paid out to entitled persons across borders and ensures that they receive health care in other EU member states. There are also some social security agreements with non-EU European states and countries outside Europe. For example, EU nationals working in Germany can continue to pay social security abroad for a year. To be eligible for this, you must obtain the form E101 and E111 (see our section on health insurance for further information).

Tip: The Federal Ministry for Work and Social Security has detailed information in different languages at its website ( www.bmas.de ). It also publishes an excellent booklet called ‘Social security at a glance’, which can be ordered or downloaded at the website.